TIN requirement of co-op members stays, says BIR

The Bureau of Internal Revenue (BIR), the Government agency for tax collection, stood pat that co-ops must submit the Tax Identification Numbers amidst calls for its repeal. In its Revenue Memorandum Circular 124-2020 issued on November 25,the BIR has made its verdict final.

The RMC was in a question-and-answer format.

On whether co-ops can file for a Certificate of Tax Exemption (CTE), in case the TINs of the members cannot be supplied yet, will result in the denial of the application, the RMC gave its verdict:

“. . . If the TINs of the cooperative members cannot be supplied because they are not yet available at the time of the application for Certificate of Tax Exemption (CTE), (the BIR) shall allow the processing and issuance/revalidation of CTEs of co-ops, provided that in lieu thereof, the co-operative shall submit original copy of Certification under oath of the list of cooperative members with their full name and capital contribution. . . . Co-ops which have been granted CTE are still required to complete and submit to (the BIR) the required TINs of their members within six (6) months . . .”

Non-submission shall be “a ground for the revocation of the CTE pursuant to RMC 102-2016.”

The RMC cited Section 236 of the National Internal Revenue Code of 1997 and Revenue Regulations 7-2012, which state that “any person required to make, render or file a return, statement or other document shall be supplied with or assigned a TIN for proper identification for tax purposes.”

Further, Executive Order (EO) 98 Series of 1999 (issued April 28, 1999) signed by President Joseph Estrada: “Requires persons, whether natural or juridical, dealing with all government agencies and instrumentalities, including government-owned and/or controlled corporations (GOCCs), and all local government units (LGUs), to incorporate their Tax Identification Number (TIN) in all forms, permits, licenses, clearances, official papers and documents which they secure from said government agencies, instrumentalities, GOCCs and LGUs (leading to increased compliance with tax laws, will be greatly improved if such TIN will be made a mandatory in all applications for any government permit, license, clearance, official paper or document by the transacting public)

At meetings with the BIR in November 2019 until January 2020, co-op leaders have requested the BIR officials to stop requiring co-ops to submit the TIN of their members because 1) many of them do are not included in the formal economy, 2) it is difficult to ask for TIN of members especially for co-ops with thousands of members, and 3) if forced to get a TIN some members might withdraw membership from co-ops, and 4) in many instances, the co-ops have lost contact with their members who may be deceased or abroad.

The BIR denied the request based on the NIRC of 1997 and EO 98.

However, the BIR has exhibited leniency by no longer requiring the TIN of “inactive members.”

At the same TWG meeting in Congress last January, the Cooperative Development Authority (CDA) was tasked with providing the ‘official definition’ of “inactive member”.

Thus, the RMC has listed criteria for “inactive members” as determined by the CDA: 1) members who are not in good standing, 2) members whose whereabouts are not known for the last continuous period of six (6) months, 3) members who do not have transaction or not patronizing any business of the cooperative for the continuous period of at least six (6) months; and 4) members who are not participating in the activities of the cooperative held within the period of six (6) months.

Further, the document says an inactive member reverts to active status when he transacts, patronizes or participates in the activities of the co-op.

Some co-op leaders at the meeting with the BIR commented that this could be a disincentive for some members to quit membership in cooperatives, since they will end up being taxed!

Another display of the BIR’s leniency is in the easing the process of securing TINs for co-op members.

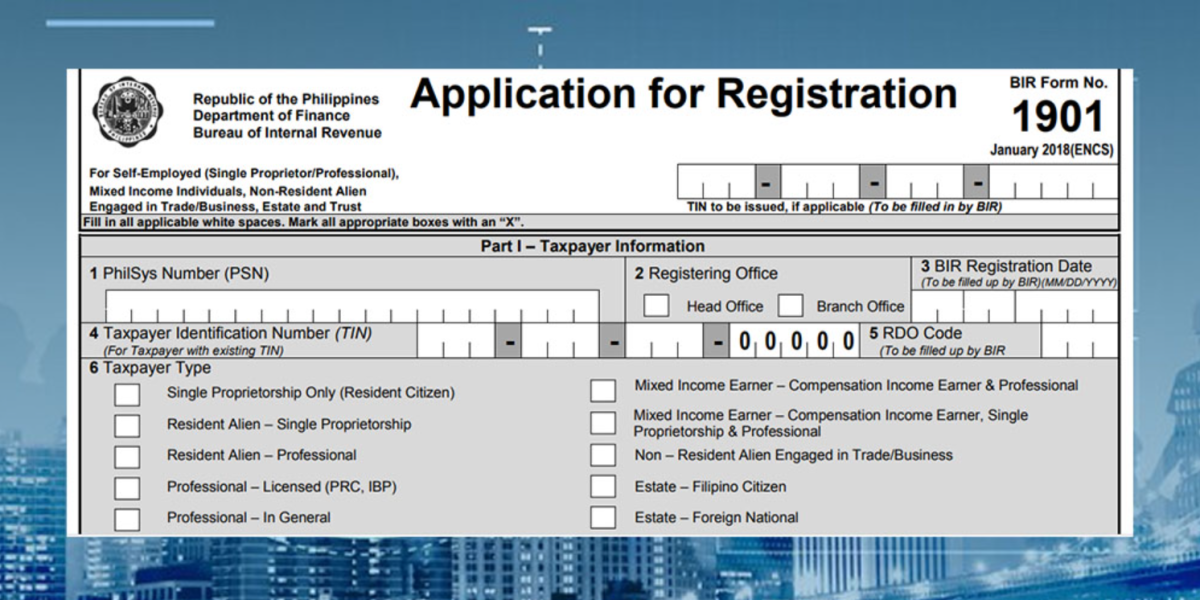

Co-ops may assist members in securing TINs by collating accomplished BIR Form 1904 plus a photocopy of a valid government ID or residence certificate, which the co-op submits to the BIR for the processing and issuance of TIN.

An even easier option is electronic Registration (eREG) which enables authorized co-ops to issue TIN.

This RMC is the result of meetings organized by COOP-NATCCO Partylist Representative Sabiniano Canama between BIR officials and co-op leaders starting November 2019 until January 2020. By February, a “Technical Working Group” composed of BIR officials, CDA officials and co-op leaders had been formed to work out details – which are thus, contained in the RMC.

Rep. Canama is also Chairperson of the House Committee on Cooperative Development.