Co-ops Must Submit ATIR On or Before July 31

Co-ops Must Submit ATIR On or Before July 31 Co-ops must prove to Government that they are truly worthy of tax exemption. The Cooperative Development Authority (CDA) issued on July 5 Memorandum Circular 2019-06 entitled “Procedures in the Submission of Annual Tax Incentive Report (ATIR) Pursuant to the Joint Administrative Order No. 1, Series of 2019, which orders all registered co-ops to prepare and submit the ATIR.

Co-ops Must Submit ATIR On or Before July 31

Co-ops must prove to Government that they are truly worthy of tax exemption.

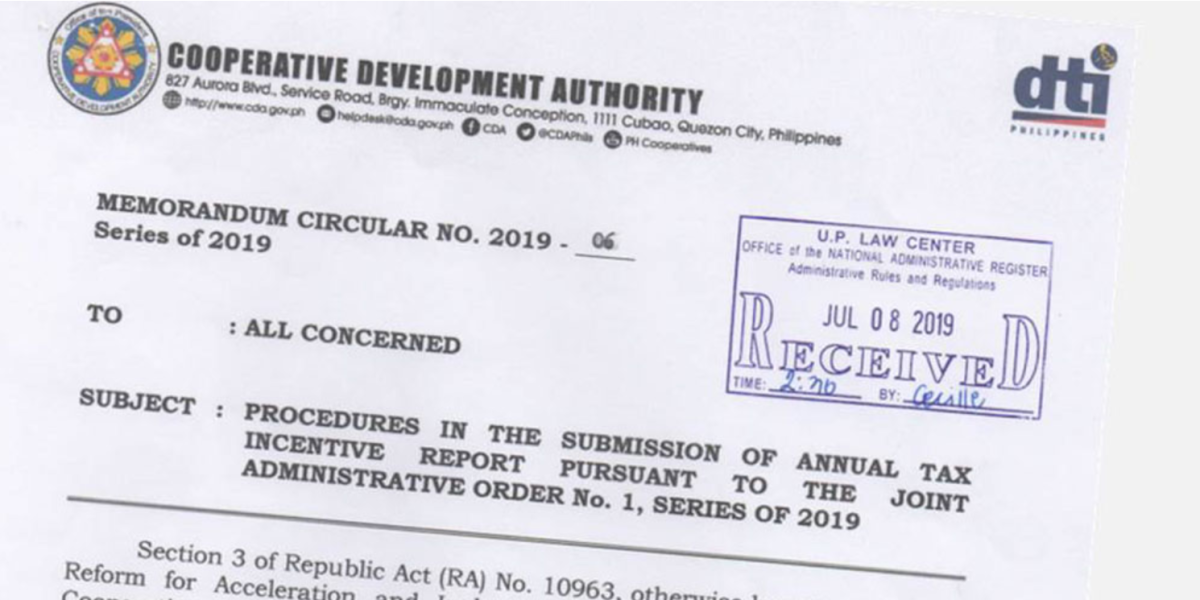

The Cooperative Development Authority (CDA) issued on July 5 Memorandum Circular 2019-06 entitled “Procedures in the Submission of Annual Tax Incentive Report (ATIR) Pursuant to the Joint Administrative Order No. 1, Series of 2019, which orders all registered co-ops to prepare and submit the ATIR.

The procedures are outlined in the memorandum. The form which co-ops are to fill up is included as well.

In 2017,when the Tax Reform for Acceleration and Inclusion Law (TRAIN Law) or Republic Act 10963 was still a Bill in Congress, co-op bloc legislators from partylists COOP-NATCCO and AGAP found that among the tax exemptions to be repealed were those that the co-ops enjoyed under the Cooperative Code.

They immediately informed the co-op leaders who summoned co-operators nationwide.

The co-op sector lobbied in Congress, in the Senate, before the Department of Finance, and on the streets for co-op tax exemptions to be retained. Their battle cry was that co-ops were taxmakers and had a positive social impact in the lives of members and the communities where they operated – and therefore should not be taxed. Another reason why co-ops should not be taxed was that portion of the Net Surplus of co-ops were earmarked for education (in the form of Cooperative Education Training Fund or CETF) and the Community Development Fund.

At a meeting, the Dept. of Finance requested concrete data or statistics for such claims. All the co-op leaders could present were word-of-mouth stories and anecdotes about how co-ops improved lives and eliminated poverty.

The Department of Finance appeared unconvinced.

Nevertheless, the TRAIN Bill became a law, and the exemptions remained.

But then another law came to the fore, the Tax Incentives Management and Transparency Act (TIMTA), which states that “It is the policy of the State to promote fiscal accountability and transparency in the grant and management of tax incentives by developing means to promptly measure the government’s fiscal exposure on these grants and to enable the government to monitor, review, and analyze the economic impact (of tax incentives) and thereby optimize the social benefits of such incentives.”

The deadline for submission of the ATIR is on July 31.

Submit on time and prove to government that co-ops are worthy of tax exemptions!