TIN requirement of co-op members stays, says BIR The Bureau of Internal Revenue (BIR), the Government agency for tax collection, stood pat that co-ops must submit the Tax Identification Numbers amidst calls for its repeal. In its Revenue Memorandum Circular 124-2020 issued on November 25,the BIR has made its verdict final. The RMC was in […]

Coops (and members) exempt from Documentary Stamps

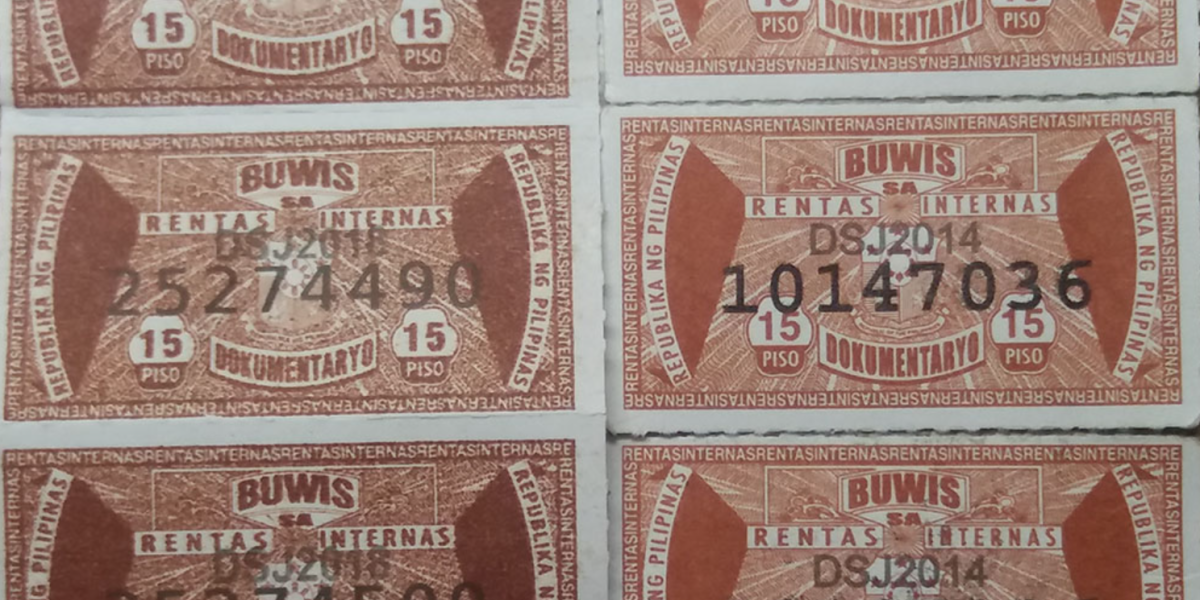

Coops (and members) exempt from Documentary Stamps It is final. The Bureau of Internal Revenue (BIR) has clarified to all its personnel that co-ops need not pay for Documentary Stamps. Thanks to a “Request for Ruling” that COOP-NATCCO Partylist Rep. Sabiniano Canama filed, the BIR issued Memorandum Circular 124-2020 dated November 25, 2020. On the […]

Co-ops to file “Request for Ruling” on Doc Stamps

Co-ops to file “Request for Ruling” on Doc Stamps Article 61 of the Cooperative Code says co-ops are exempt from Documentary Stamp Tax (DST). So why are DST’s required when co-ops transact with members or other entities? At the TWG discussions on July 21, some co-ops complained to the Bureau of Internal Revenue (BIR) that […]

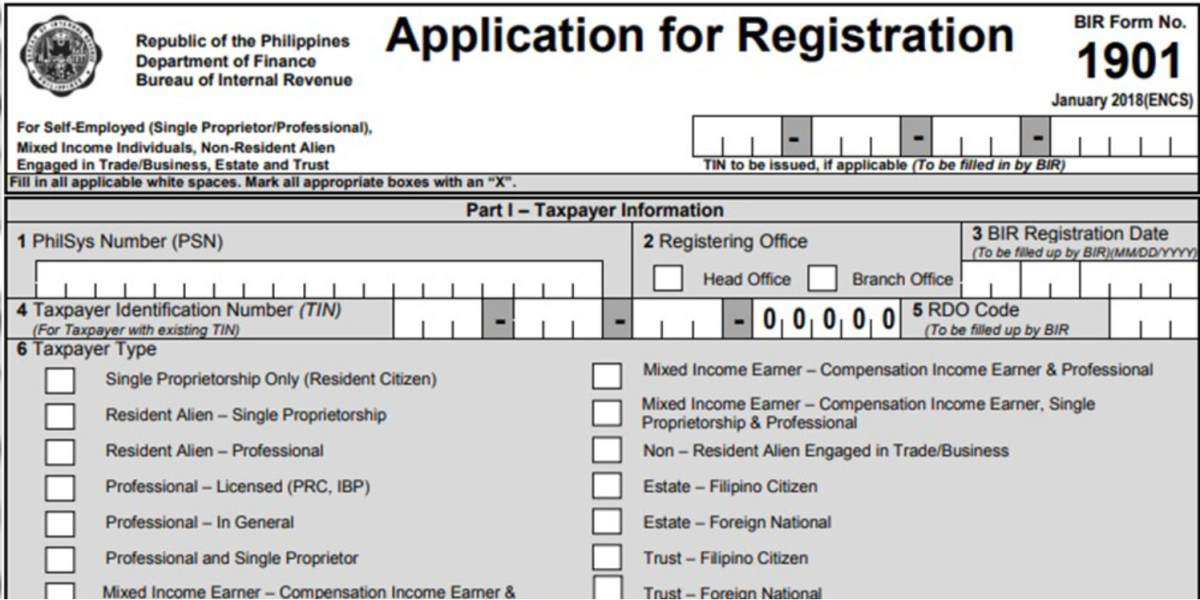

Co-ops can issue TIN to members online with “eREG” (TIN Series Part 4)

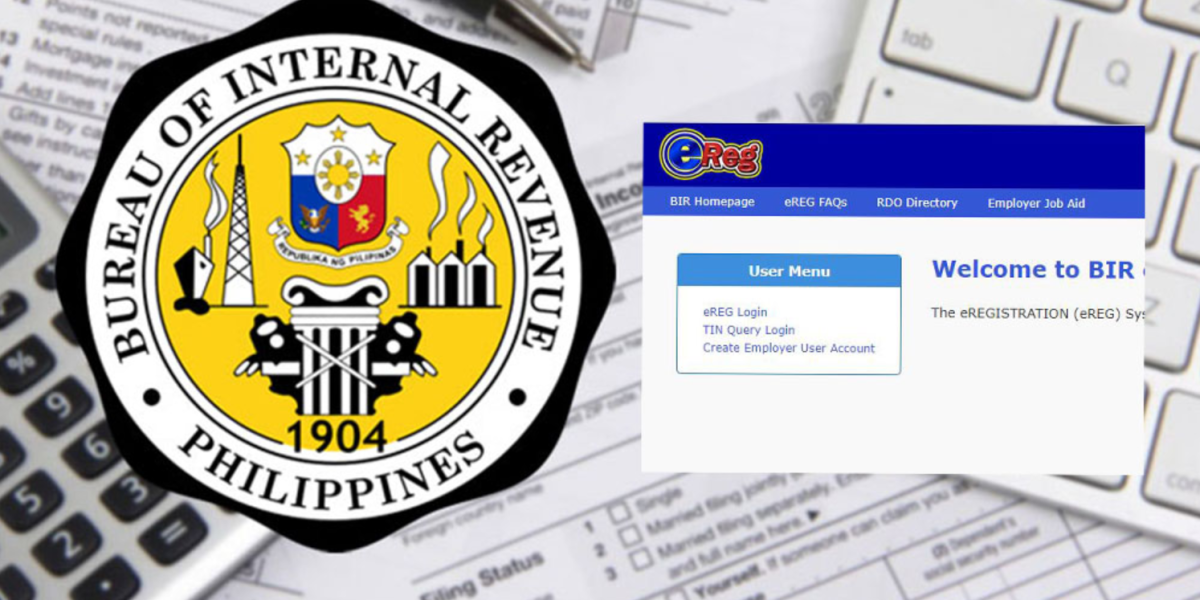

Co-ops can issue TIN to members online with “eREG” (TIN Series Part 4) To ease the process of obtaining or retaining a co-op’s Certificate of Tax Exemption (CTE), the BIR announced at a Tax Exemption Technical Working Group (TWG) on July 15 that co-ops can issue to members their Tax Identification Number (TIN) online. When […]

Co-ops to issue TINs to members (TIN Series Part 3)

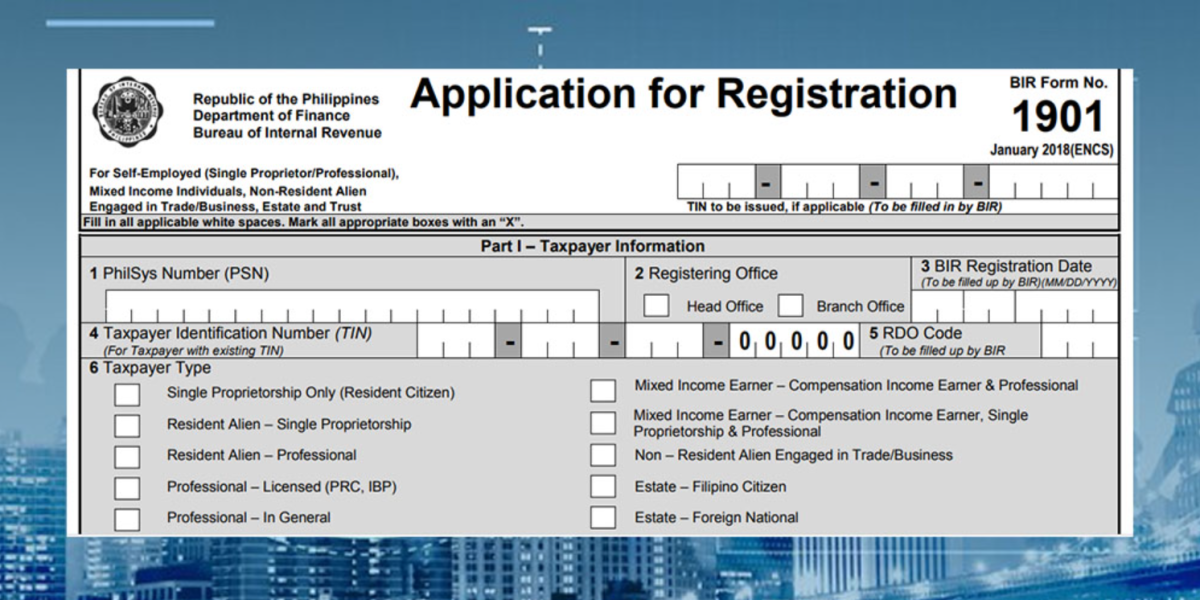

Co-ops to issue TINs to members (TIN Series Part 3) QUEZON CITY — The Tax Identification Number (TIN) of co-op members is very important because without it, the Bureau of Internal Revenue (BIR) cannot issue a co-op its Certificate of Tax Exemption (CTE). Co-op leaders at a series of meetings with the Department of Finance, […]

Why do co-ops have to submit TIN of members? (Part 2)

Why do co-ops have to submit TIN of members? (Part 2) At a Tax Technical Working Group (TWG) online meeting discussing co-op tax exemptions held last July 15, COOP-NATCCO Partylist Rep. Ben Canama said that “the TIN requirement on co-ops has been one of the reasons why co-ops “cannot appreciate very much the tax exemptions […]

Why do co-ops have to submit TIN of members?

Why do co-ops have to submit TIN of members? QUEZON CITY — When the Republic Act 9520 became law in February 2009, co-operators rejoiced because the Code enforced in Articles 60 & 61 tax exemptions for cooperatives when transacting with members. But the celebrations stopped cold as the realization came that there were many requirements […]

CDA says: “We tried to mitigate the harshness of JAO 1-2019”

CDA says: “We tried to mitigate the harshness of JAO 1-2019” At the discussions of the Technical Working Group on the Tax Exemption held March 4 in the House of Representatives, leaders of primary co-ops complained that the penalties for non-submission of the Annual Tax Incentive Report (ATIR) are “too harsh.” The Joint Administrative Order […]

Co-ops complain: Penalty for ATIR non-submission ‘too harsh’

Co-ops complain: Penalty for ATIR non-submission ‘too harsh’ QUEZON CITY – “Very few co-ops have availed of the tax exemptions. Why is it that we have exemption in the law but after a decade only 33% of co-ops have availed? Why give co-ops the privilege of exemption when they will be deprived in the end? […]

Working Group to ease how co-ops obtain & maintain CTE

Working Group to ease how co-ops obtain & maintain CTE QUEZON CITY – The difficulties of co-ops in obtaining their Certificate of Tax Exemptions may end soon as the Bureau of Internal Revenue (BIR) and the Cooperative Development Authority (CDA) have sat down with sector leaders on March 4 in the House of Representatives to […]